Trust FAQs

The appointor (sometimes called Principal or Guardian) is the ultimate controller of a trust. The appointor has the power to appoint and remove the trustees. It is not essential that the trust has an appointer. CGW deeds will work with or without an appointor.

However, it is useful to have an appointor to change the trustee in situations such as death or insolvency of a trustee. The appointor may be an exisitng trustee, a named beneficiary or a third party.

Some trusts have an ‘independent’ appointor (such as an accountant) to reduce the risk of individual beneficiaries being held to control the trust.

We recommend against having a sole individual trustee who is also a beneficiary.

There is an argument that, where a sole trustee is also a beneficiary, all of the net income is assessable to that trustee because they have the unilateral power to retain or distribute to other beneficiaries.

While we are only aware of one occasion where the ATO has raised this as a possible issue, the prudent approach is to have joint trustees for clients who do not want a corporate trustee. If there are joint trustees then no beneficiary has unilateral power to determine how the income is distributed.

The maximum number of trustees you can have is four.

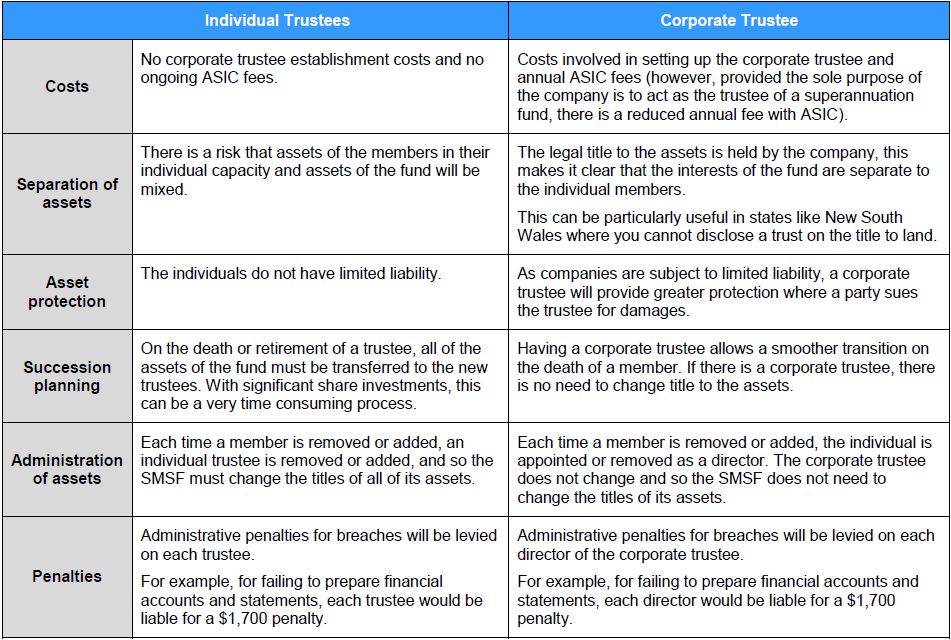

A trustee is personally liable for debts incurred on behalf of the trust and, although the trustee has the right to be indemnified out of the assets of the trust, it is usually preferable for a company to be trustee so that the risk of trust activities is quarantined to the assets in the trust. This company should have no other activities.

Having individual trustees might be considered simpler and cheaper because there is no establishment fee for the company or ongoing ASIC fees or reporting obligations. However, the advantages of having a corporate trustee generally outweigh the company establishment costs.

With individual trustees, all assets must be transferred into the name of a new trustee if a current trustee resigns or dies. However, if the trustee is a company, there is simpler succession because there is no need to transfer assets if a director dies or resigns. You only need to deal with the shareholding and directorships.

The costs associated with maintaining a corporate trustee are not substantial.

The directors of a trustee company can be beneficiaries in their individual capacity while still being in control of the trust.

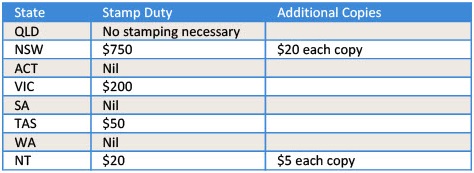

Generally, the establishment of a trust deed will be subject to either nil or nominal duty. The requirements in relation to stamping a trust deed vary from state to state. The stamping fees for discretionary and unit trusts, if by declaration/settlement of cash only are set out below:

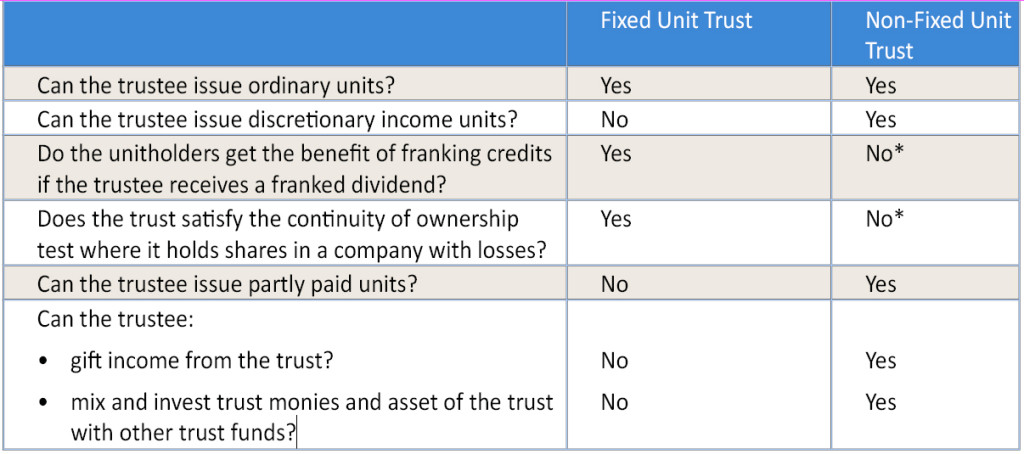

There are a number of issues you should take into account in choosing between a fixed and a non-fixed unit trust. The key differences are summarised below:

*Unless the trust lodges a family trust election

Recent cases also highlight the fact that most private unit trusts do not meet the current criteria for a fixed trust – therefore if you have an existing unit trust deed, you may need to update it if you require the trust to be fixed.

A fixed trust is more restrictive than our ordinary unit trust, which may be a problem if there are non-arm’s length unitholders.

For example, many decisions have to be approved by a unanimous resolution of unitholders (e.g. amendments to the trust deed).

Recent cases also indicate that, unless unit redemptions and issues have to be based on a valuation determined on a net asset basis and in accordance with Australian accounting principles, the unitholders may not have a fixed entitlement.

While we do not agree with the recent case law, it is likely the ATO will seek to take this valuation position and therefore the safest option is to include these valuation methods in the unit trust deed.

The deed can be amended in future (by unanimous consent) if an alternative valuation method is agreed.

A direct descendants trust deed contains provisions that prohibit capital distributions to anyone other than a direct descendant of the initial clients unless the initial clients consent.

This deed may be attractive to clients who have concerns about sons or daughters-in-law or other third parties (e.g. trustee in bankruptcy) accessing the trust capital.

However, the trust has the usual wide range of income beneficiaries so the clients still have substantial flexibility for tax planning purposes.

Company FAQs

A proprietary company must have at least one director who ordinarily resides in Australia. Only an individual who is at least 18 may be appointed as a director of a company.

A proprietary company is not required to have a secretary but if they do have one or more secretaries, one of them must also ordinarily reside in Australia. Only an individual who is at least 18 may be appointed as a secretary.

Australian taxation law requires every company carrying on business in Australia, or deriving income from property in Australia to be represented by a public officer.

The company must notify the Australian Taxation Office of the identity of its public officer within three months of commencing business or deriving income in Australia. The public officer is the Australian Taxation Office’s official point-of-contact in relation to the company.

Only an individual who is at least 18 years old and generally resides in Australia can be appointed as a public officer.

Shares do not have ‘standard’ rights.

Different rights attach to different classes of shares and these rights may also be different to the rights attaching to the same class of shares in another company.

The rights attaching to the different classes of shares are set out in a company’s constitution.

Clients will need to consider what rights they intend the proposed shareholders to have and the tax implications of issuing more than one class of shares.

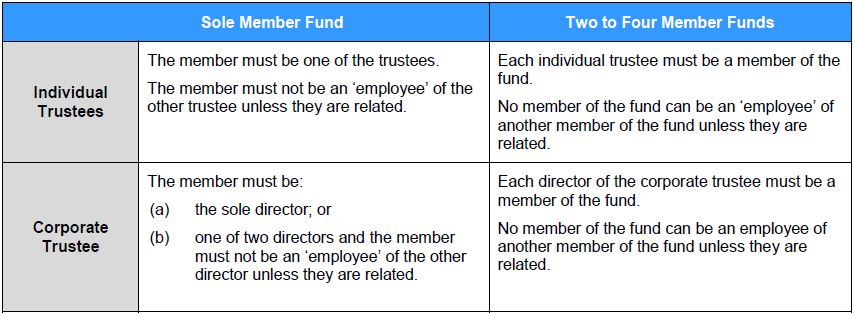

Self-managed superannuation fund FAQs

The requirements in relation to stamping a deed establishing a SMSF vary from state to state. As at June 2015, the only jurisdictions in Australia that require stamping are Tasmania ($50 nominal duty) and the Northern Territory ($20 nominal duty plus $5 for each copy of the SMSF trust deed). None of the other jurisdictions require new SMSF trust deeds to be stamped.